Why to Consider Insurance When Planning Structure Placement

Submitted by the MBMA

If a building is isolated with no surrounding structures and it burns, the fire typically started in that building. On the other hand, if there are neighboring structures or vegetation that can catch fire, the fire may have spread to the building. The tendency of fire to spread from one structure to another is recognized in fire insurance rates, as historically, fire was the first hazard that insurance addressed. To insurers, the nature of the other structures surrounding a building can be as important as the building itself.

The closer together buildings are, the greater the fire peril. The density of buildings in an area can also create firefighting challenges. Therefore, the greater the distance between buildings, the lower the risk. The greater the combustibility of the construction of either the insured structure or the neighboring buildings, the higher the insurance premium will need to be to cover the potential risk. Exposure data on adjacent buildings, such as walls, hazards, construction, and distance, will affect underwriting decisions and rates.

Insurance rate modifications are made by considering the kind and degree of exposure hazard. Exposure hazards are anything that occur off-site that may put the insured building at risk such as other buildings, hazardous operations, or natural hazards. Exposure hazards include adjacent structures. For example, a property next to a storage tank containing flammable liquids can present a serious risk, which an insurer may deem unacceptable.

Evolving Technology

While the fire risk remains key, insurers also consider multiple location characteristics when determining rates, not just the proximity to another structure. As the insurance industry evolves and adopts new technologies, there is an increasing amount of sophisticated data available to accurately quantify risk at a specific street address.

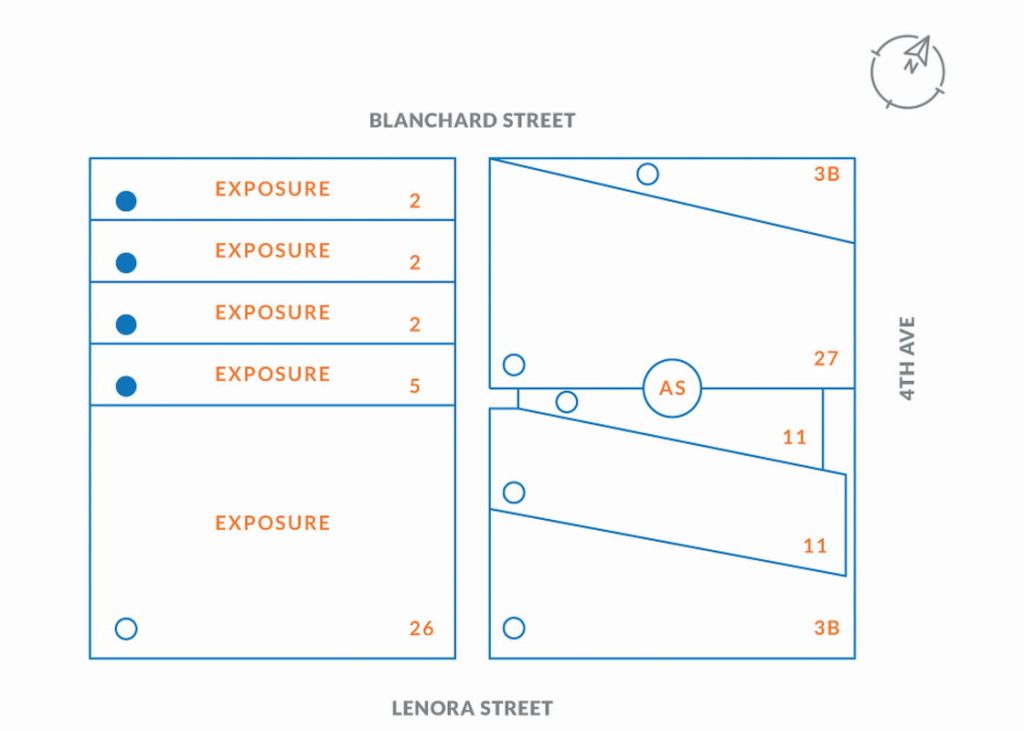

Figure 1 is an example of interactive maps that provide specific information on adjacent buildings including construction class, exposure risk characteristics (such as distance to fault lines) and types of occupancy. National advisory organizations, such as ISO and the American Association of Insurance Services (AAIS), and state rating bureaus such as the Washington Surveying and Rating Bureau (WSRB), supply location risk data to insurers.

ISO and SCOPES

ISO utilizes its proprietary Specific Commercial Property Evaluation Schedule (SCOPES) to analyze the specifically rated properties it surveys. WSRB offers an online tool to assist insurers in determining distances to, and types of, external exposures. Read that insurance bulletin at www.mbma.com/Insurance.html (look for Bulletin 2).

What is important to remember about external exposure hazards is that they are, by definition, outside of the control of a building’s designer and owner. Often little can be done from a design standpoint to reduce or mitigate the impact of hazards existing in the adjacent environment. It is always recommended to evaluate properties that neighbor any proposed site.

Options for mitigating the risk that a building designer can undertake include:

- Maintaining adequate clear space between buildings

- Fire walls (especially increasing the rating of exterior walls) with appropriately rated openings (as allowed by applicable codes)

- The addition of a complete fire-suppression system (if not already required).

Premises Exposure

Premises Exposure refers to the hazards within the structure. Storage areas, balconies, stairs, handrails, lighting, fire escapes, and elevators can play a significant role in underwriting decisions. Critically important is if, and how, a building is divided into multiple tenant spaces. Insurers develop ratings based on the types of occupancies planned for the structure. They will re-evaluate the rate as tenants change if there appears to be a higher risk of fire or other type of loss. As an example, a clothing store in a strip mall presents a different fire hazard than a neighboring restaurant. A paint spray booth or an office area within a manufacturing facility also represent different levels of hazard. Proper separations with appropriate fire-rated wall assemblies can help to mitigate the negative impact of higher hazard areas within a structure.

Besides physical exposures (to other buildings), insurers consider additional exposures, including local wildfire risk, the possibility of damaging winds and water (hurricanes and storm surge), severe thunderstorms (wind and hail), flooding and earthquakes. For more information on wind and earthquakes risks, see MBMA insurance bulletins Nos. 5 and 6 (again available at https://www.mbma.com/Insurance.html). MB

The Metal Building Manufacturers Association (MBMA) provides these insurance bulletins as informational guides for MBMA members. The information contained in these bulletins is general in nature and is not intended to serve as legal advice. Members are advised to consult with their own counsel and/or insurance broker on matters specific to them. Learn more at www.mbma.com/Insurance.html.

This article is from the Spring 2023 issue.